We focus on four race and ethnicity groups for this analysis: Black, Latino, White, and Overall. A positive gap means that a minority group is more likely to receive an appraised value lower than contract price relative to the White group. For the purpose of this Research Note, an “appraisal gap” means the percent difference in the share of properties or applicants receiving “appraisal value lower than contract price” between minority and White groups. The term "appraisal gap" has been used in various papers with varying meanings. We analyze the percentage of properties or applicants receiving "appraisal value lower than contract price." The metric is calculated separately for Black and Latino versus White groups. In this Research Note, we use the term "appraisal value lower than contract price" to refer to appraised values that are lower than the contract price for home purchases. 8 With these assumptions, we compare the appraisal value to the contract price, which we take as the benchmark in purchase transactions. Our research is based on two assumptions: (1) markets for home sales are functioning well, regardless of the share of minority people living in a neighborhood and (2) the contract price is a reasonable benchmark in purchase transactions. The focus of our research is to study whether the appraisal outcome is different for minority groups versus the White group.

IntroductionĪn appraisal is meant to opine on the market value of a home, so that lenders have adequate collateral for the loan. Our preliminary modeling results suggest that a property is more likely to receive an appraisal lower than the contract price if it is in a minority tract. Finally, in the fifth section we build models to test whether the minority tract flag based on the minority concentration in the tract explains appraisal gaps beyond structural and neighborhood characteristics. Our research shows that differences in comparable sale (or comp 6) distances, comp reconciliation, 7 variances in sale prices of comps, and possible systematic overpayment for properties by minorities cannot explain the appraisal gaps for minority tracts observed in our data. In the fourth section, we explore several possible explanations for the observed appraisal gaps in minority neighborhoods. Our analysis shows gaps for a large fraction of appraisers who provide valuations in both minority and White tracts.

In the third section, we test whether the observed gaps are driven by only a few appraisers. Second, we examine the raw differences in the percentage of applicants that receive an appraisal value lower than the contract price and find that minority applicants are more likely to receive an appraisal value lower than the contract price.Īfter observing these gaps, we conduct exploratory research to begin to understand what causes the valuation gaps for minority versus White tracts. 4 We find substantial appraisal valuation gaps 5 for minority versus White tracts. 3įirst, we examine the raw differences in the percentage of properties that receive an appraisal value lower than the contract price in minority tracts compared to those in White tracts.

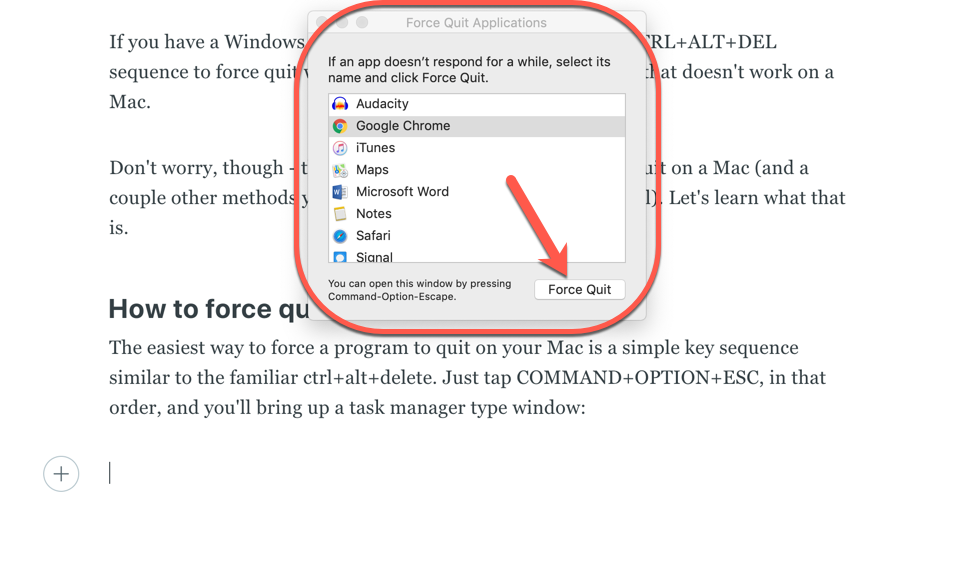

CONTENT CONTROL IN WORD FOR MAC MAC

To follow up on several stories of potential purchase appraisal 1 bias in various news outlets, 2 Freddie Mac kicked off a study of whether minorities are more likely to receive an appraisal value that is lower than the contract price during purchase transactions. My Home by Freddie Mac® Resources to help you rent, buy and own your home.ĭo we own your mortgage? Find out if Freddie Mac owns your loan using our secured lookup tool.ĭid we finance your apartment? Use our lookup tool to see if Freddie Mac financed your apartment building.ĬreditSmart® Financial and homeownership education resources all about you. View sites for Renters, Buyers and Owners.Optigo Academy One-stop learning for Optigo lenders. Multifamily Division For Optigo® lenders, investors and borrowers.

CONTENT CONTROL IN WORD FOR MAC HOW TO

Seller/Servicer Guide Learn how to work with us with our Guide Bulletins and Industry Letters. Single-Family Division Insights, products, and technology to help you grow your business.Ĭlient Resource Center Resources, training, System Status, and FAQ to help you run your business.

0 kommentar(er)

0 kommentar(er)